south san francisco sales tax rate 2020

The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco. A yes vote was a vote in favor of increasing the local hotel tax incrementally from 10 percent to 14 percent in 2021 with funds used for general city purposes.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

The minimum combined 2022 sales tax rate for South San Francisco California is.

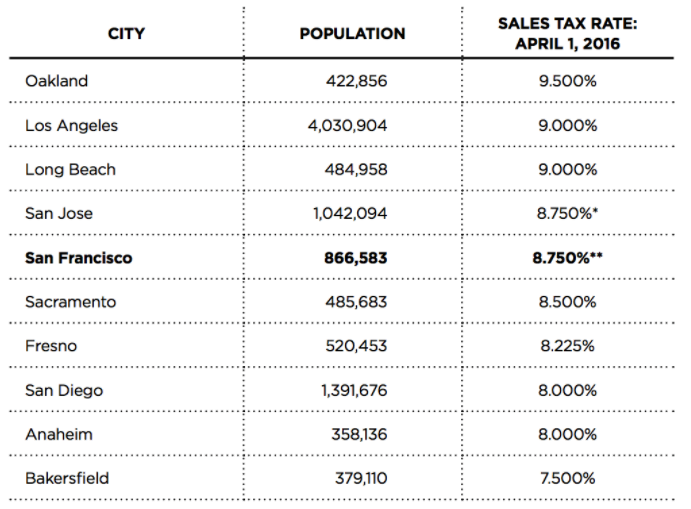

. A City county and municipal rates vary. The December 2020 total local sales tax rate was 9750. The California sales tax rate is currently.

The minimum combined 2022 sales tax rate for South San Francisco California is 988. What is the sales tax rate in San Francisco County. What is the sales tax rate in South San Francisco California.

B Three states levy mandatory statewide local add-on sales taxes at the state level. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

San Mateo Co Local Tax Sl 1. A sales tax. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing.

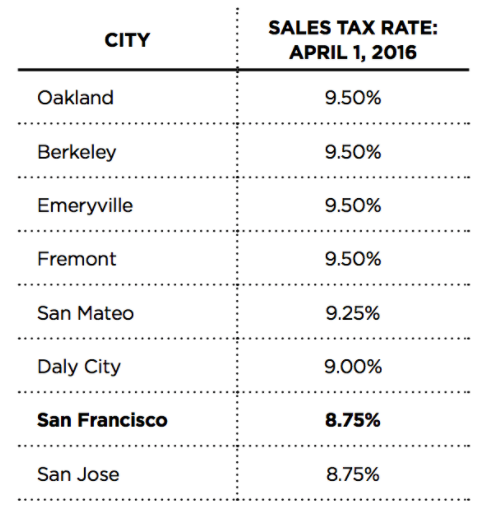

In San Francisco the tax rate will rise from 85 to 8625. Most of these tax changes were approved by voters in the November 2020 election the California Department of Tax and Fee Administration said. 4 rows The 85 sales tax rate in San.

City of San Mateo 9625 City of South San Francisco 9875 SANTA BARBARA. You can print a 9875 sales tax table here. Presidio of Monterey Monterey 9250.

South Shore Alameda 10750. Collection Procedures for Transient. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

The current total local sales tax rate in South San Francisco CA is 9875. South San Francisco Sales Tax Rate 2021. The tax rate given here will reflect the current rate of tax for the address that you enter.

Tax returns are required monthly for all hotels and motels operating in the city. South San Francisco CA Sales Tax Rate. The California state sales tax rate is currently 6.

The December 2020 total. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The South San Francisco California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in South San Francisco California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within South San Francisco California.

Please ensure the address information you input is the address you intended. The South San Francisco California sales tax is 750 the same as the California state sales tax. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc.

The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. Most of these tax changes were approved by voters in the November 2020. The South San Francisco sales tax rate is.

The current Conference Center Tax is 250 per room night. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. California requires S corporations to pay a 15 franchise tax on income with a minimum tax of 800.

Gross receipts tax gr proposition f was approved by san francisco voters on november 2 2020 and became effective january 1 2021. State Local Sales Tax Rates As of January 1 2020. Interactive Tax Map Unlimited Use.

There is no applicable city tax. 5 digit Zip Code is required. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

For tax rates in other cities see. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. California 1 Utah 125 and Virginia 1.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. Did South Dakota v. The County sales tax rate is.

How much is sales tax in San Francisco. Download all California sales tax rates by zip code. Ad Lookup Sales Tax Rates For Free.

Filing Requirements from the CA Franchise Tax Board. This is the total of state county and city sales tax rates. The current Transient Occupancy Tax rate is 14.

These rates are weighted by population to compute an average local tax rate. The December 2020 total local sales tax rate was 8500. Otherwise you will owe the annual tax rate of 884 and must file Form 100 California Franchise or Income Tax Return.

Sales tax rate differentials can induce consumers to shop across borders or buy products online. Type an address above and click Search to find the sales and use tax rate for that location. California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes ALAMEDA COUNTY 1025 City of Alameda 1075 City of Albany 1075.

The minimum combined 2021 sales tax rate for south san francisco california is. The minimum combined 2022 sales tax rate for San Francisco County California is 863. Its sales tax from 595 percent to 61 percent in April 2019.

South San Francisco 9875. This is the total of state and county sales tax rates. In San Francisco the sale of Levis Plaza for an estimated price of 820 million added 400 million to the roll and the newly opened Chase Center home of the Golden State Warriors added 350.

States With Highest And Lowest Sales Tax Rates

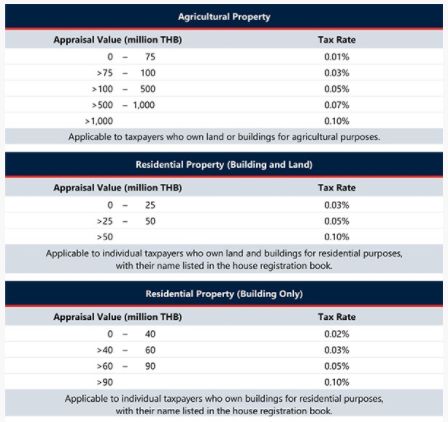

No Change For Thailand S Land And Building Tax Rates For 2022 Property Taxes Thailand

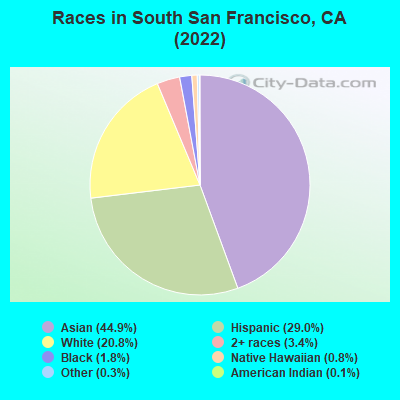

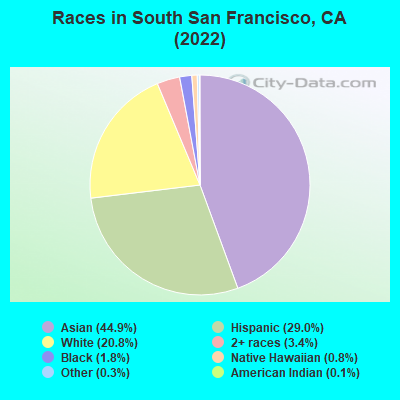

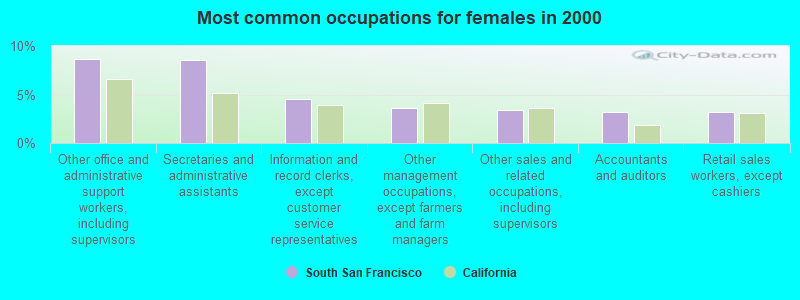

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

California Sales Tax Small Business Guide Truic

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Expected Tax Increases Have Bay Area Wealthy Moving With Urgency San Francisco Business Times

Chicago Il Cost Of Living Is Chicago Affordable Data

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

How Do State And Local Sales Taxes Work Tax Policy Center

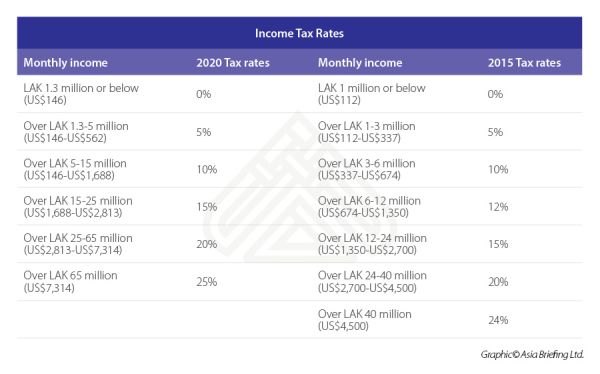

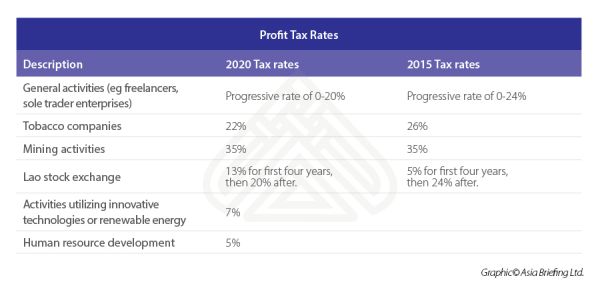

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

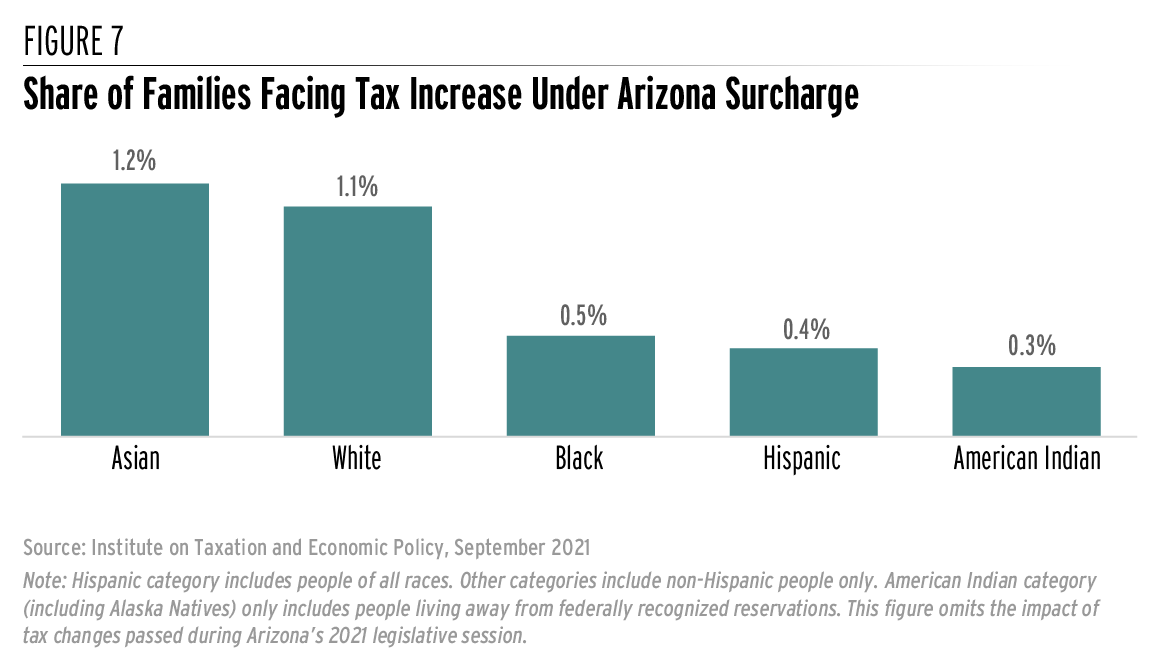

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

How Do State And Local Sales Taxes Work Tax Policy Center

Laos To Implement New Income Tax Rates Income Tax Lao Peoples Democratic Republic

What Are California S Income Tax Brackets Rjs Law Tax Attorney

San Francisco Bay Area Apartment Rental Report Managecasa

California Sales Tax Rates By City County 2022